Published December 2022

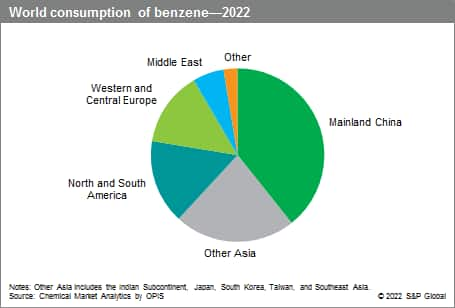

The primary chemicals produced from benzene are ethylbenzene, cumene, cyclohexane, and nitrobenzene. Ultimately, benzene is used in a wide range of downstream sectors including construction, automobiles, electronics, and appliances, as well as other diverse durables and consumables. Over the past decade, benzene consumption has shifted from the West (Western Europe, North America) to the East (Northeast Asia, Middle East, Southeast Asia), and mainland China has become an increasingly important influence on the global benzene market.

Over the past decade, mainland China has accounted for almost all the additional benzene requirements globally by adding derivatives capacity, and so, mainland Chinese benzene consumption has increased at a much higher average rate than any other region. Over the same period, a decline or stagnation of demand was recorded for all other regions except the Middle East and Southeast Asia. Global demand for benzene grew significantly during 2017–18, but started to slow in 2019 and then fell in 2020 because of the COVID-19 pandemic and the diverse government lockdowns that followed in most major economies. However, markets have broadly recovered during 2021–22 from both supply and demand perspectives, despite some persisting shipping bottlenecks.

The following pie chart shows world consumption of benzene:

Benzene production is influenced by many different dynamics that vary from one region to the next. As benzene is produced primarily as a coproduct, its supply is not driven by global benzene demand but rather by demand for other products (gasoline, ethylene, p-xylene, steel). With a wide variety of potential sources available (refineries, steam crackers, PX units, coke ovens), the benzene market equilibrium is quite complex and is analyzed in detail in this report.

Over the forecast period and beyond, several trends are projected to alter the course of development of the benzene market globally; changes in mobility solutions, sustainability targets, growing environmental consumer awareness, changing regulations pertaining to the use of plastics in packaging, and increasing recycling activity are all expected to impact benzene consumption in the medium-to-long term.

For more detailed information, see the table of contents, shown below.

IHS Markit’s Chemical Economics Handbook – Benzene is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

IHS Markit’s Chemical Economics Handbook – Benzene has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with IHS Markit’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics. This report can help you

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability