Published December 2021

Diisocyanates and polyisocyanates are reactive intermediates characterized by terminal isocyanate groups, which typically are reacted with the hydroxyl groups of polyol coreactants to form polyurethanes. The most widely used diisocyanates and polyisocyanates are aromatic in their composition. A product mixture of polymethylenepolyphenylene isocyanate (also called polymeric MDI or PMDI) and p,p′-methylene diphenyl diisocyanate (MDI) is derived from aniline (via benzene). Toluene diisocyanate (TDI, also called tolylenediisocyanate) is derived from toluene. Other diisocyanates include specialty products, such as pure MDI, 1,6-hexamethylenediisocyanate (HDI), and isophoronediisocyanate (IPDI).

The global MDI and TDI markets are very large-volume and provide important raw materials for the manufacture of polyurethane products; however, the marketplace is very concentrated, and there is significant worldwide trade in both MDI and TDI. As a result of the rapid growth of the MDI market, especially in the production of polyurethane foam insulation and oriented strandboard (OSB) wood composites for construction markets, the MDI market is more than twice the size of the TDI market. TDI is consumed primarily in flexible polyurethane foams used in cushioning products such as mattresses, furniture, and automotive seats. Global TDI and MDI markets are forecast to grow at rates of 3–4% annually during the next five years.

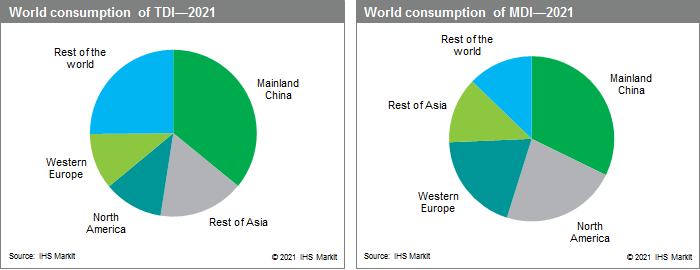

The following pie charts show world consumption of TDI and MDI:

As global demand for MDI and TDI has slowed in recent years, some of the major producers have shut down older facilities (sometimes in conjunction with the addition of new plant capacity and/or opening plants with improved manufacturing processes) and increased export volumes to the faster-growing regions of the world such as Asia Pacific, Central and South America, and Central and Eastern Europe. In addition, most major producers have a worldwide presence—production facilities and/or joint ventures in North America, Europe, mainland China, Japan, and other regions.

For the TDI and MDI industries, the high degree of market concentration (the five largest producers control more than 80% of global capacity in 2021) is due to sophisticated technologies, uncertain availability of raw materials including aniline and chlorine, and high capital cost barriers. There continues to be consolidation in the market.

Strong growth for polyurethane and its raw materials—MDI, TDI, and aliphatic diisocyanates (as well as polyether and polyester polyols)—is driven by several important trends; probably the most important is the drive toward improved energy efficiency and the use of rigid polyurethane foam insulation including laminate boardstock for building roofs and walls; spray rigid polyurethane foam for walls, roofs, and industrial applications; and pour-in-place systems for refrigerators and freezers, and metal panels. Another market that is driving growth is in the automotive industry, with the move toward lighter vehicles (known as lightweighting), in seating, acoustic insulation, and polyurethane adhesives (instead of rivets).

Mainland China is the most important global market for diisocyanates, accounting for about one-third each of the global TDI, MDI, and aliphatic and specialty diisocyanates markets in 2021. TDI, MDI, and aliphatic diisocyanate markets will continue to expand in developing countries in Asia, especially India and Southeast Asia.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook –Diisocyanates and Polyisocyanates is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Chemical Economics Handbook –Diisocyanates and Polyisocyanates has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements