Published December 2023

Adiponitrile (ADN) is a key precursor to hexamethylenediamine (HMDA) production. More than 87% of HMDA is consumed in the nylon 66 chain, with nonnylon uses mostly in hexamethylene diisocyanate (HDI) for high-performance polyurethane paints and coatings, and epoxy curing agents, which grew strongly in the earlier years of the decade and remained consistent during the last five years. Over the last several years, ADN supply has been extremely tight as it bumps against the upper end of its effective capacity, thus crimping the supply of downstream HMDA and nylon 66. HMDA demand slowly recovered from the 2008 downturn through 2018 but then declined in 2020 because of the impact of COVID-19 on the global market. HMDA consumption is expected to recover over the forecast period to 2028.

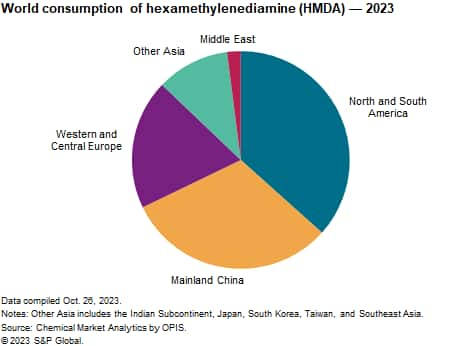

Northeast Asian HMDA demand has grown the fastest over the last five years, led by mainland China, following its capacity expansions for nylon 66 and HDI. HMDA demand in Northeast Asia will continue to be the major driver in the global market; mainland China is expected to become the largest consumer of HMDA during the forecast period. The rest of Asia will remain heavily dependent on HMDA exports from the western regions in the forecast years.

The following pie chart shows world consumption of HMDA:

Adiponitrile is produced only in the United States, Western Europe and Japan, and since 2019, in mainland China. The United States continues to be the main exporter of ADN, as gradual capacity increases in the United States have led to increased production. As capacity of ADN consistently increases in mainland China, global trade in ADN has declined sharply since 2019; this trend is expected to continue in the forecast period as mainland China becomes more self-sufficient.

Investments in new ADN capacity have come onstream and are expected to continue over the next five years, as consumption is expected to grow at slightly higher rates; global operating rates are expected to increase steadily during the forecast period. HMDA capacity is expected to increase at nearly the same pace as consumption growth over the next five years, and so operating rates will remain relatively stable.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook– Hexamethylenediamine-Adiponitrile is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information,including

Key benefits

S&P Global’s Chemical Economics Handbook –Hexamethylenediamine-Adiponitrile has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade and economics.

This report can help you:

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability