Published October 2023

The properties of melamine resin provide product advantages. These properties include abrasion, chemical, physical and thermal resistance; hardness; and the ability to combine with other chemicals to make melamine resins with good handling and molding properties. The high nitrogen content of melamine resin also provides fire-retardant properties. The major end-use markets for melamine include construction/remodeling, automotive production and original equipment manufacture (OEM). Thus, demand is influenced largely by general economic conditions.

More than 70% of global melamine consumption is for laminates and wood adhesives production. Laminates are found in products such as furniture, floors, kitchen cabinets and countertops, and walls. Wood adhesives based on melamine are found in a number of wood products, including medium-density fiberboard (MDF), particleboard and plywood. Melamine-modified wood adhesives improve the durability and moisture resistance of the final woodboard.

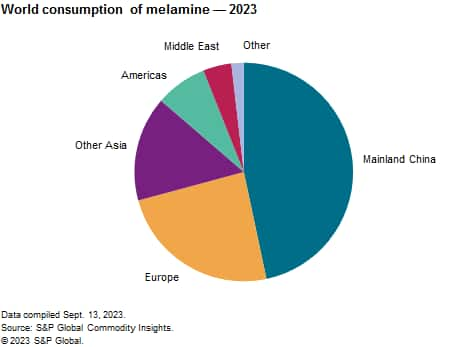

The following pie chart shows world consumption of melamine:

Overall, economic performance will continue to be the best indicator of future demand for melamine. Demand in most downstream markets is greatly influenced by general economic conditions. As a result, demand largely follows the patterns of the leading world economies. The major end-use markets include construction/remodeling, automotive production and original equipment manufacture.

During the last several years, melamine consumption has increased as global economies have improved and end-use industries such as housing, construction and automotive have continued to grow. In 2020, melamine consumption declined because of the COVID-19 pandemic and the resulting negative effect on the global economy and the melamine end-use industries such as construction and automotive. Melamine consumption recovered in 2021 and continued to grow until late 2022, when the global economy experienced some slowdowns. As a result, consumption will grow slightly in 2023 and will experience modest growth in the years thereafter. Global melamine consumption growth is expected to be 3%-4% per year during 2023–28.

The modest global growth will be driven by mainland China, which accounts for nearly half of world melamine consumption, as well as almost three-fourths of total world capacity. Relatively stronger growth will also take place in other parts of Asia, such as South Asia and Southeast Asia. Modest growth is expected for other regions of the world, including the Middle East, Central and Eastern Europe, Eurasia, North America and Central and South America. More limited growth is expected in Western Europe, and relatively flat growth is forecast for Japan.

The largest global melamine producers are in mainland China and Europe; most major producers operate in only one region or country. There many midsized producers that meet their own captive requirements.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook – Melamine is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Chemical Economics Handbook – Melamine has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability