Published October 2022

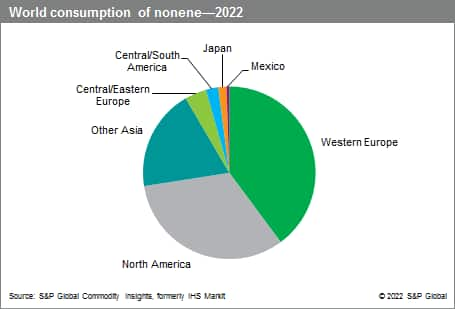

Isodecyl alcohol accounts for more than 50% of global demand for nonene, with Exxon being the dominant player. Other important applications include nonylphenol, neodecanoic acid, and nonylated diphenylamine. Future growth is highly dependent on the markets in these core applications. Production of nonylphenol will show some growth only in geographical areas where cost-effectiveness is the primary objective and the use of nonylphenolethoxylates (NPEs) is not restricted. Mainland China and India are the key players for nonylphenol because of the use of NPEs in their large textile industries. This situation could change if some form of legislation is introduced.

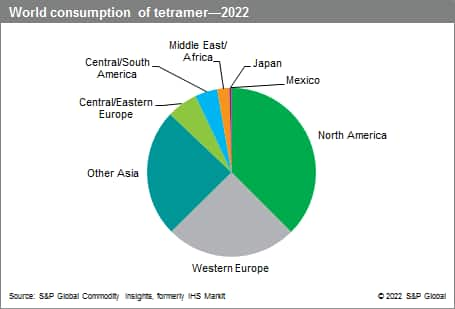

North America is the largest producer of propylene tetramer, followed by Europe. Dodecylphenol represents the largest end use. Dodecylphenol is converted into its calcium, magnesium, or barium salt (phenate) for use as a detergent in lubricating oils. This end use has grown significantly in Other Asia over the past three years. This has driven North American production for export into Asia during the past few three years. Over the forecast period, this trend is expected to continue, but the growth rate will likely slow. The North American and Western Europe markets for tetramer-based lubricating oil additives are flat, but there will likely be continued growth in the export market for formulated lube oil additive packages containing detergents based on dodecylphenol produced in these regions.

Consumption for dodecylbenzene (DDB) will continue to decrease in Central and South America, while consumption in other regions will have limited growth. DDB is the precursor of dodedecylbenzene sulfonates (i.e., branched alkylbenzene sulfonates, also known as BAS). The latter product is used as a surfactant in household detergents in less-developed countries. BAS is very slow to biodegrade and is increasingly being displaced by other surfactants that have better biodegradability.

The following pie charts show world consumption of nonene and tetramer:

Nonene and tetramer are branched olefins produced by the polymerization of propylene. 1-Dodecene, a linear alpha-olefin produced from ethylene, is not included in this report. Nonene is also referred to as propylene trimer; the former is the more commonly accepted name. Tetramer is also referred to as propylene tetramer or branched dodecene. Once manufactured primarily as components of polymer gasoline, these products are now valued primarily for chemical use.

Neither nonene nor tetramer has been extensively tested for health, safety, and environmental problems because they are used predominantly as chemical intermediates. However, in 2010, they were registered under REACH. As chemical intermediates they are allowed to be used in controlled environments; however, it is known that both are mildly toxic when inhaled or ingested. Also, when heated to decomposition, both emit an acrid smoke and irritating fumes. Several downstream products of nonene and tetramer have been affected by environmental and toxicology concerns.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook – Nonene (Propylene Trimer) and Tetramer is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key Benefits

S&P Global’s Chemical Economics Handbook – Nonene (Propylene Trimer) and Tetramer has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability