Published September 2022

Of the polyurethane raw material products industries, the polyester polyol industry is the least concentrated; the others, polyether polyols and isocyanates, are much more concentrated. The polyester polyol industry also tends to have the least sophisticated manufacturing processes and the lowest capital costs. Polyester polyols are manufactured from aliphatic diacids (or esters), aromatic diacids (or esters or anhydrides), or caprolactone. The simplest polyester polyols are prepared by the reaction of a diacid, diester, or caprolactone with a glycol or a polyhydric alcohol; however, occasionally a mixture of aliphatic and aromatic acids is used. The desired reaction is the production of high percentages of hydroxyl-terminated polyesters. The range of molecular weights depends on the relative amounts of the glycol and acids, the reaction conditions, and the desired end use (flexible/rigid foam or CASE).

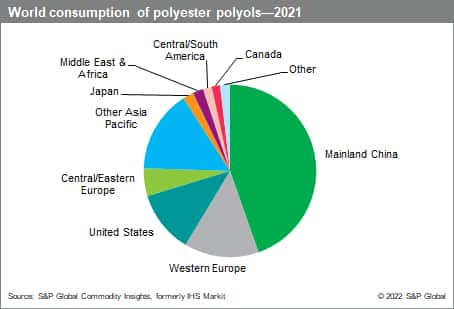

The following chart presents world consumption of polyester polyols:

The most dynamic markets for polyester polyols continue to be mainland China, India, and other Asia Pacific markets; North America and Europe have also shown improved growth. In terms of end uses, increasing global demand for nonfoam applications, especially for polyurethane elastomers (often for shoes in mainland China and Other Asia) and artificial leather, are major growth drivers. Other important markets are polyurethanes/polyisocyanurates (PUR or PU/PIR) insulation foam, spurring demand for aromatic polyester polyols in the most developed industrial countries of North America and northwestern Europe, as well as in mainland China because of its move to build more energy-efficient buildings.

The largest market for polyester polyols is in a variety of nonfoam applications, accounting for more than 60% of global consumption. The largest nonfoam sector is in polyurethane elastomers, including shoe sole materials (the largest market in mainland China). Mainland China is the largest polyester polyols player and consumer in the world, but only for aliphatic polyester polyols; the mainland Chinese market for aromatic polyester polyols is still small.

Since 2011, the global growth for polyester polyols has been uneven, with only mild-to-low growth in Western Europe, the United States, and Japan, and the greatest growth in mainland China (3–4%), India, and Other Asia (high growth rates but on smaller volumes). As a result of the COVID-19 pandemic in 2020, the global economy and major downstream industries (automotive, construction, manufacturing) were severely impacted, and the global polyester polyols market declined. As the pandemic started receding in 2021, the polyurethane and polyols markets have also started recovering. Consumption of polyester polyols in global markets will grow at an average annual rate of around 3.5% during 2022–27.

The seven largest producers account for 37% of total polyester polyol production capacity. Largest global producers are Stepan, Huafeng Group, COIM, BASF, and Xuchuan Chemical (Suzhou) Company.

Over the last several years, the industry has offered a wider range of sustainable options for polyurethane manufacturers. Sustainable polyester polyols are the most viable option of all the polyurethane raw materials. Sustainable polyester polyols include products produced from bio-based raw materials and from recycled sources.

Special risk factors for further market development include the following:

- The Russia-Ukraine conflict will slow global economic growth as policies tighten.

- Impacts stemming from the COVID-19 pandemic and other variants.

- Inflation to increase with producer and consumer prices surging.

- Geopolitical risks, such as unrest in the Middle East and Africa.

- The debt crisis of several European countries as well as the effects of Brexit.

- The slowing of mainland China’s economy and a slowdown in many of its industrial and construction sectors; mainland China represents the largest share of the global market.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook – Polyether Polyols is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including:

Key Benefits

S&P Global’s Chemical Economics Handbook – Polyurethane Foams has been compiled using primary interviews with key suppliers, organizations and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence, expert insights into industry dynamics, trade and economics.

This report can help you:

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability