Published October 2023

Sodium sulfate is used mostly in detergents, but also finds use in sodium sulfide production and glass, pulping and textile applications. Detergent applications have shown steady growth, especially in developing countries; in 2023, detergent uses account for 42% of global consumption. Kraft pulp is the second-largest applications, with a 14% share, followed by textiles (13%). Glass is the fourth-largest use for sodium sulfate, and is also the market most impacted by economic conditions (especially for construction markets and automobile production). Sodium sulfide production accounts for 7% of total sodium sulfate consumption in 2023; this market is almost exclusively in mainland China, where sodium sulfide is still produced by reduction of sodium sulfate with powdered coal.

Sodium sulfate can be recovered from naturally occurring brines or lakes that contain significant amounts of the product. It is also obtained as a by-product of the production of man-made fibers, chromium chemicals, hydrochloric acid and formic acid, as well as from lead-acid and lithium-ion battery recycling or desulfurization of flue gases. Byproduct sodium sulfate can have a purity similar to that of the natural product.

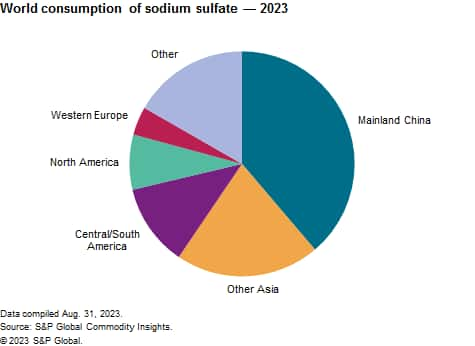

The following pie chart shows world consumption of sodium sulfate in 2023:

Mainland China is the world’s largest market and is forecast to grow at 0.4% annually. It has the largest reserves of mirabilite (a major source of natural sodium sulfate) and has been building and expanding capacity to meet global demand. As production costs are relatively lower than in the rest of the world, mainland China has become the major supplier of sodium sulfate for global consumption.

Mainland China is also the predominant consumer of sodium sulfate, followed by other Asian countries, particularly South and Southeastern Asia, and Central and South America. Mainland China is faced with serious overcapacity, while domestic demand in the United States and Europe has decreased slightly or stagnated in recent years. This situation has stimulated exports from these areas. Exports from mainland China have doubled since 2004, with about half going to Other Asia and half to the rest of the world. Brazil, Colombia, Argentina and Chile are becoming significant consumers, as are Vietnam, Indonesia, the Philippines, Thailand and South Korea. Central and South America is almost entirely dependent on imports, with trade from mainland China and Spain accounting for the majority of imports.

Historically, sodium sulfate production was mainly from natural resources in Canada and Russia, along with pockets in various parts of Latin America, the western United States, Spain and India. However, large quantities are currently produced as a by-product from nitrate/iodine processing, rayon spinning, the Mannheim process for hydrochloric acid production and in the manufacture of sodium dichromate, phenol, resorcinol, formic acid, boric acid, lithium carbonate and ascorbic acid (vitamin C). In recent years, natural production has become predominant because of the increased production in mainland China.

Global demand for sodium sulfate is expected to grow at between 1.5 and 2.0% per year during the forecast period to 2028. Consumption for detergents is forecast to grow at 1.6% per year on average, with kraft pulp at just below 3.0% per year and textile applications at 1.7% per year.

For more detailed information, see the table of contents, shown below

S&P Global’s Chemical Economics Handbook – Sodium Sulfate is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Chemical Economics Handbook – Sodium Sulfate has been compiled using primary interviews with key suppliers, organizations and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence, expert insights into industry dynamics, trade and

This report can help you:

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability