Published May 2022

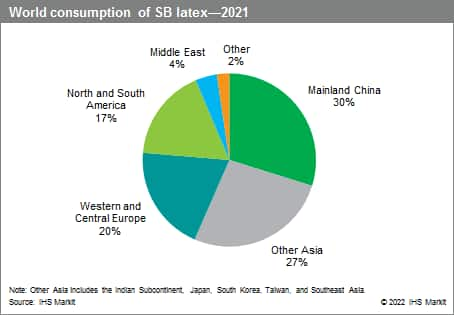

In the last decade, North America and Western Europe have shut down a significant amount of SB/SBR latex capacity following a decline in demand (especially for the coated paper and carpet industries). North American capacity has declined by close to 40% and Western Europe has lost 18% of its capacity. The markets in Japan and Other Asia have been flat to declining as well during the same period. The exception is mainland China, which has seen capacity expansion to meet demand for SB latex end-use applications. As a result of a growing middle class, improved standards of living, and adoption of global consumer brands, capacity and production quantities are currently ramping up in mainland China. However, in the next five years, mainland Chinese capacity is expected to remain stable.

This report mainly covers supply/demand for styrene-butadiene latexes (SB latex and SBR latex), which are classified based on styrene content. SB latexes contain at least 45–80% styrene, and SBR latexes contain less than 45% styrene. In industry, SB latexes are most widely used for coated/pigmented paper and paperboard coatings and carpet backcoatings. The remaining consumption is for SBR latexes, which are used mostly for molded foams and adhesives. Styrene-butadiene-vinylpyridine terpolymers, which are used almost exclusively for tire cord treatments, represent a minimal portion.

The following pie chart shows world consumption of SB latex:

The production of SB latex is highly fragmented worldwide. More than 50 producers globally, with two market leaders—Trinseo and BASF—together control more than 30% of the market. Because of the fragmentation and low overall growth in the market, it is possible to expect a further rationalization of the supply structure, including more capacity rationalization (including unit closures).

Consumption of SB/SBR latexes is forecast to grow at about 0.8% per year from 2021 to 2026, in part because of the following:

- The impact of digitalization on paper production and movement to carpet flooring alternatives.

- Growing imports of coated papers into traditional producing regions (North America).

- Coated paper mill closures and general reductions in production.

In paper coatings applications, SB latex has better properties than other materials, especially for wet applications such as paper drink carriers. But in other applications, SB latex has competition from butyl acrylate–based systems, and also from the increasing starch content in more conventional paper grades. Biobased latex has shown only small penetration so far, and is not expected to have a significant impact.

The largest application for SB latex is paper coatings. Carboxylated SB latex is the dominant synthetic pigment binder for coated papers. SB latex–based coating systems offer high coating speed, and enhanced pigment binding power that results in smoothness, higher gloss level, brightness, opacity, and water resistance at lower cost than the alternatives. A majority of SB latex binders are used on coated printing papers such as magazines, annual reports, label stock, advertising flyers, and catalogs. The remainder is used for coating paperboard products (commercially produced coated paperboard) such as folding cartons for food packaging uses. SB latex improves brightness uniformity as well as print performance. In addition, it optimizes glueability, stiffness, and scoring, and enhances ink and varnish performance

SB latexes are also used in paper saturation for the production of specialty papers and board to obtain resistance to grease or petroleum, or to improve strength at high temperatures. Saturated specialty papers and board are used for book covers, gaskets, containers, masking tape, and various sandpapers.

The second major outlet for SB latex is in backcoatings for tufted carpets. Latex backcoatings hold the tufts in place, anchoring the pile fibers, providing improved stability and resistance to fraying or tuft loss at the cut edges of the carpets. The latex functions as the laminating adhesive for a secondary backing (primarily polypropylene), but it can also function as the actual backing on some carpets (so-called unitary back carpets). The styrene content in SB latexes varies depending on the physical features desired in the final product.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook – Styrene-Butadiene Latexes is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Chemical Economics Handbook – Styrene-Butadiene Latexes has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability