Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 10, 2019

Marginal field legislation could significantly boost Angolan field development

In May 2018, the Angolan government published a decree with new incentives for the development of marginal fields. In April 2019 a list of potentially applicable fields was announced in the public domain. The new terms significantly improve the returns available from marginal field developments, potentially unlocking up to 4,500 MMboe of undeveloped hydrocarbon reserves, of which 60% could potentially be developed in the near term due to close proximity to existing infrastructure.

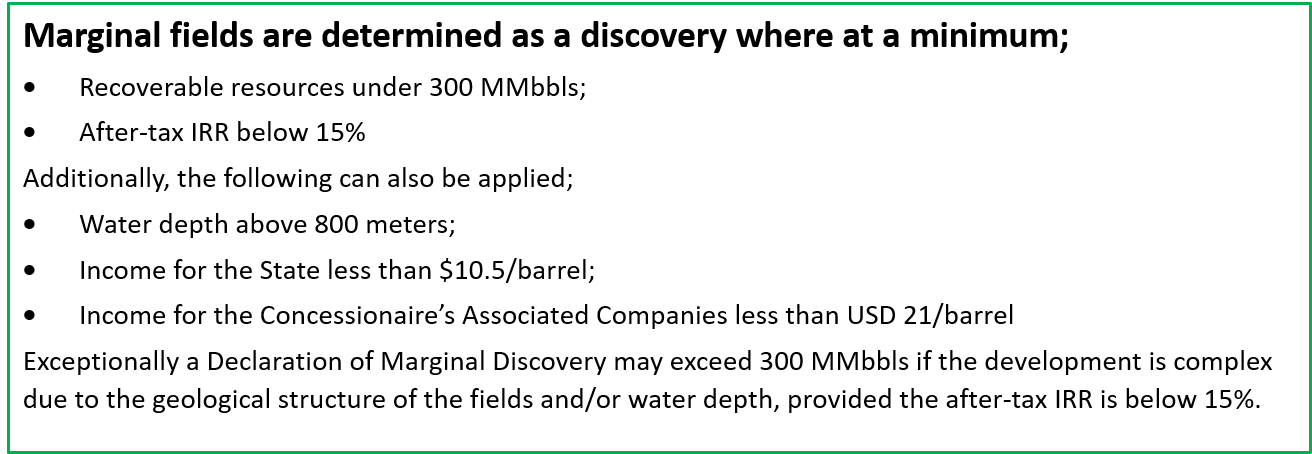

Figure 1: Marginal fields are determined as a discovery where at a minimum

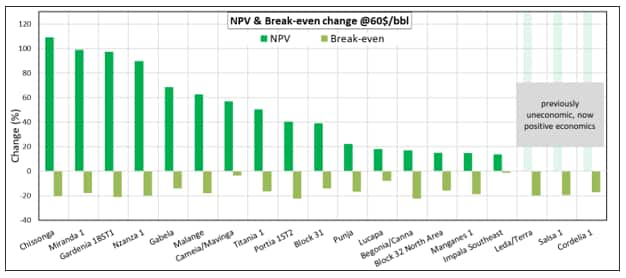

The application of the marginal terms is expected to increase the NPV of the projects between 15% and 80%, while the break-even price is estimated to drop by 15% to 20%. A number of assets with previously challenging economics, due to a combination of an ultra-deep water environment and small size, are now expected to become economic under the marginal field terms.

Figure 2: NPV and Break-even change @60$/bbl

The projects expected to benefit the most from the marginal terms are Chissonga, Miranda and Gardenia. Even with the improved economics the development of the Miranda and Gardenia fields could still be challenging due to the field size and stranded location.

Leda/Terra, Salsa and Cordelia are three projects which are expected to be impacted the most by the updated fiscal terms. They were previously estimated to be of negative or marginal value due to their stranded location, water depth and relatively small size. With the application of the new terms, Leda/Terra and Salsa are estimated to now have robust economics.

The Block 31 asset, representing fields not due to be developed individually, and Portia are estimated to be the most robust economically under the existing fiscal terms given the reserve size. The application of the marginal terms is estimated to increases the asset value by a further 40%.

Learn more about the solution that we used in this detailed valuation analysis, IHS Markit Vantage.

Ismini Katsimpardi is a Senior Technical Research Analyst at IHS Markit.

Posted 10 June 2019

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmarginal-field-legislation-boost-angolan-field-development.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmarginal-field-legislation-boost-angolan-field-development.html&text=Marginal+field+legislation+could+significantly+boost+Angolan+field+development++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmarginal-field-legislation-boost-angolan-field-development.html","enabled":true},{"name":"email","url":"?subject=Marginal field legislation could significantly boost Angolan field development | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmarginal-field-legislation-boost-angolan-field-development.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Marginal+field+legislation+could+significantly+boost+Angolan+field+development++%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmarginal-field-legislation-boost-angolan-field-development.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}