Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsMainland China autonomous vehicle development on a different track

By Surabhi Rajpal, Senior Research Analyst, S&P Global Mobility

The S&P Global Mobility AutoIntelligence service provides daily analysis of global automotive news and events. We deliver timely context and impactful analysis for navigating the fast-moving industry. Behind the Headlines offers a bi-weekly dive into recent top stories.

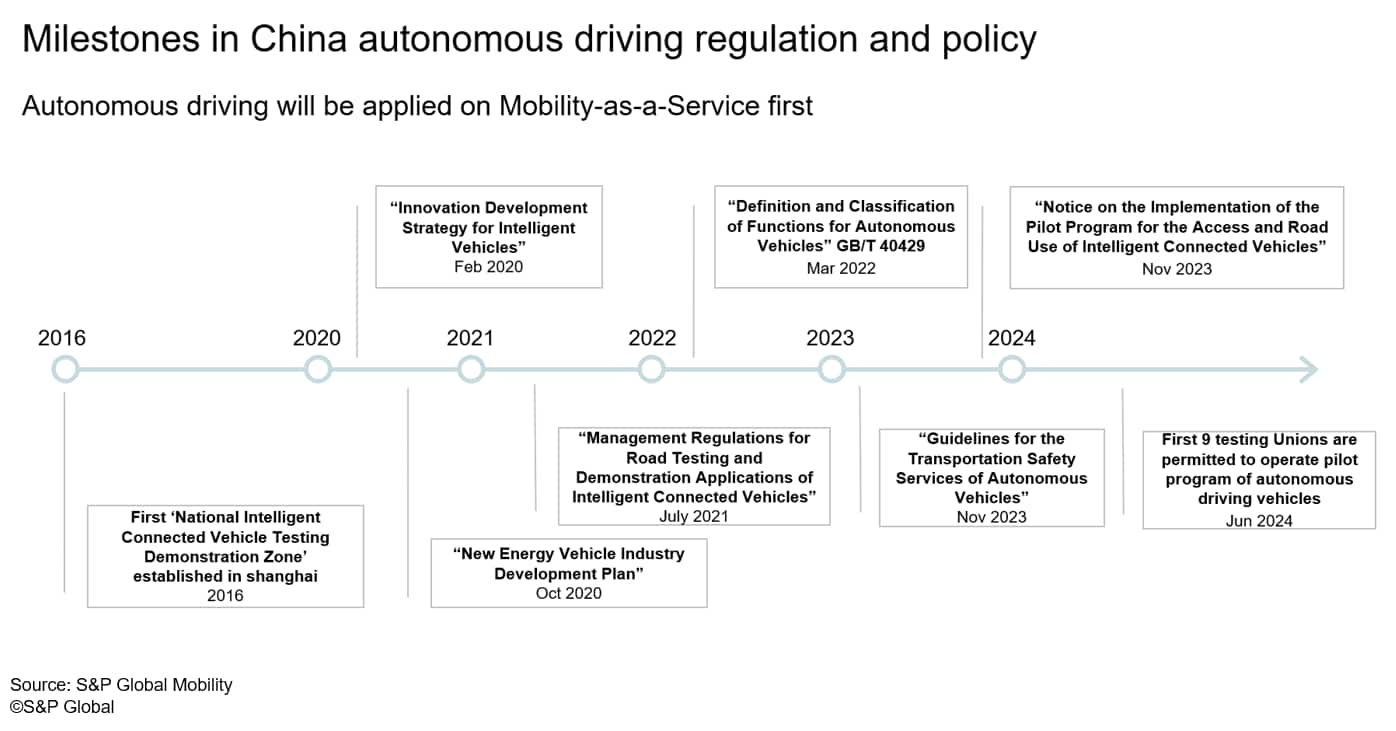

China's autonomous vehicle (AV) sector is experiencing significant growth on its own and compared to other markets. In mainland China, there is extensive road testing being conducted in several cities. Major tech companies such as Baidu, Pony.ai, and WeRide are leading the charge in testing and deploying AVs across various cities. Expansion is bolstered by initiatives from the Chinese government, such as establishing pilot zones, issuing licenses, and developing regulations and standards.

In June 2024, the government selected 20 cities to participate in a pilot program aimed at creating roadside infrastructure and a cloud-based control platform for the operation of "smart connected vehicles."

At an August 2024 conference in Beijing, the Ministry of Public Security announced that 32,000 kilometers of roads have been established for AV testing and that 16,000 test licenses have been issued nationwide. Currently, at least 19 cities are testing robotaxis and robo-buses, with nine automakers granted approval in June to test advanced automated driving technologies on public roads.

Here is a breakdown on how these advancements are playing out across different cities.

Wuhan

The city of Wuhan is recognized as a global leader in intelligent vehicle transportation, having permitted nearly 500 autonomous taxis (with a supervisor in the driver's seat) from Baidu's Apollo Go, which is approximately 1% of total taxis in operation in the city. Although the scale of the deployment is relatively small in number of vehicles, the deployment area spans the breadth of the city. Baidu aims to achieve break-even in Wuhan by the end 2024 and plans to deploy 1,000 robotaxis in the city by then.

Guangzhou

Guangzhou now has 933 testing roads with a one-way distance of approximately 1,980 km, of which over 260 km are expressways. Over the past two months, the city released draft regulations for intelligent connected vehicles (ICVs) to promote their widespread adoption and develop roadways that accommodate both automated and human driving. The city then launched its second set of ICV testing routes on expressways, connecting major transportation hubs like Guangzhou South Railway Station and Guangzhou Baiyun International Airport. Apollo Go and Pony.ai are approved autonomous ride-hailing services and operate 50 autonomous buses covering 10 routes. By June 30, these buses had completed 525,000 trips, served 1.073 million passengers and traveled 1.742 million kilometers.

Beijing

By early 2024, more than 1,160 kilometers of public roads have been opened for trials, with 384 vehicles from 18 companies approved to participate. Baidu, Pony.ai, WeRide, and AutoX are currently authorized to operate automated shuttle services with a safety driver between Beijing Daxing International Airport and the Yizhuang area in the southern part of the city. In July, Beijing released a draft regulation seeking public feedback on the use of AVs for public transport, ride-hailing services, car rentals, and other urban travel options. This marks the most significant progress in AV technology development in Beijing since road tests were first allowed in late 2019.

Shanghai

Since opening its first road section for AV testing in March 2018, Shanghai has established four testing demonstration zones in Jiading, Lingang, Fengxian and Jinqiao. Currently, 32 companies have secured approval for road testing and pilot operations of 794 vehicles. Shanghai has opened 1,003 roads, spanning over 2,000 km, for AV testing. The city plans to put driverless robotaxi services on designated roads in the Pudong financial district, with licenses granted to four robotaxi companies - Baidu Apollo, AutoX, Pony.ai and SAIC AI Lab - and aims for over 70% of newly produced cars to be equipped with Level 2 or Level 3 automated systems by 2025.

Shenzhen

Shenzhen began permitting fully AVs without human drivers to operate on specific roads, following a local regulation regarding smart and internet-connected vehicles in 2022. The city has opened 944 km of public roads for testing, including 67 km of highways. Additionally, Shenzhen is set to launch a fleet of 20 autonomous minibuses for public transport this year and operations on its first autonomous bus route, the B998 Autonomous Line, began in August. The municipal government's action plan, released in June 2023, aims to expand the city's ICV industry to generate 200 billion yuan in revenue by 2025.

China's dominance in the autonomous vehicle market

China's strong push for automated driving, bolstered by significant government support and regulatory frameworks, positions it as a potential leader in the development of AV technology and relative to commercialization of the AV industry.

In mainland China, an improved investment climate and consumer demand for advanced technology has prompted many manufacturers to incorporate high-level advanced driver-assistance systems (ADAS) and Automated Driving Systems especially in Level 2+ use cases. Direction from policymakers on the importance of AI and its applications in autonomous vehicles also provides a long-term orientation to technology development in China and some reassurance to OEMs. Tesla is reportedly working with Baidu to support its deployment of Full Self-Driving (FSD) in China and is expected to intensify competition among Chinese EV manufacturers such as Xpeng and Nio, who are already offering their own Automated Driving Systems.

The AV industry in the United States is also experiencing steady growth, with companies such as Waymo, Cruise, and Zoox actively developing and refining their technologies, conducting extensive trials to ensure safety and reliability. Waymo remains the leader in the US market and is currently the only company operating fare-collecting driverless taxis with a fleet of about 700 vehicles. By the end of August 2024, Waymo's US paid weekly robotaxi rides reached 100,000, versus 50,000 per week in May 2024. Meanwhile, Cruise, supported by General Motors, resumed testing with a limited number of human-driven vehicles in April in Phoenix, expanding locations in third quarter 2024, after a pedestrian incident last year in California which saw its permissions withdrawn.

The US operates on a self-certification system, allowing manufacturers to confirm that their products comply with safety standards such as the Federal Motor Vehicle Safety Standards (FMVSS), which may result in varied implementation. Certification and approvals processes at a state level add another layer for the US; along with mostly agreeable weather, US states of Arizona and Nevada have been home to more testing and deployment. California is the most stringent, requiring California Department of Motor Vehicles approvals for testing with or without a driver, and the state determines if the AV can be allowed to charge riders through a second regulatory body in the California Public Utilities Commission.

S&P Global Mobility's September 2024 Autonomy Forecasts indicates that development in mainland China is accelerating, with projections of approximately 250,000 Level 4 AVs sold for mobility services in 2034, representing less than 1% of light-vehicle sales. Level 4 AV sales for mobility services in the US are growing at a similar pace, expected to reach about 230,000 units in 2034, which translates to a market share of about 1.5%. Meanwhile, Europe is anticipated to lag behind the US, with sales starting later and only reaching about 37,000 units in 2034.

Get a free trial of AutoIntelligence.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.