Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsRising Vehicle Inventories Boost Brand Loyalty

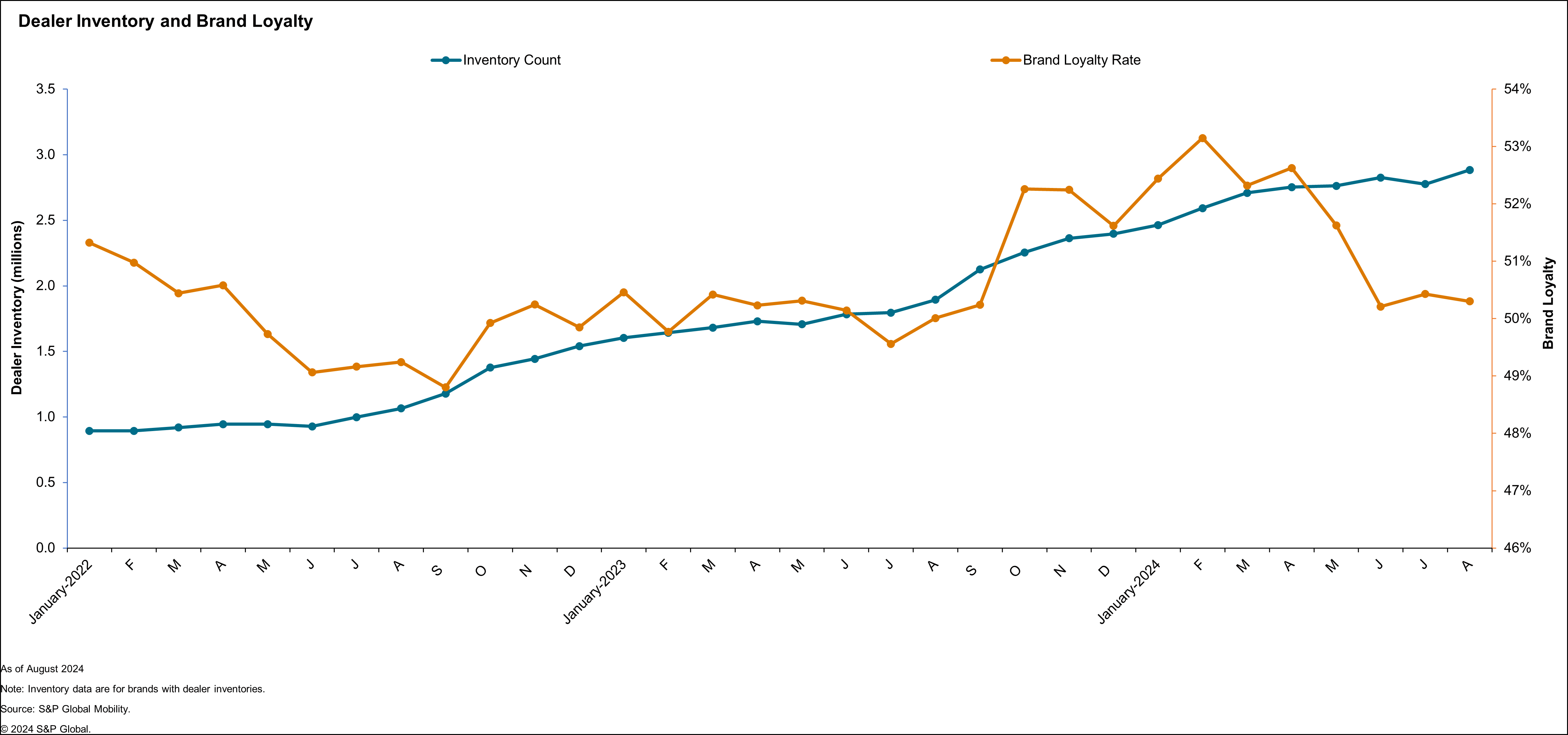

The increase in new vehicle inventories, from less than 1 million units in January 2022 to almost 3 million units in August 2024, has brought about other major changes to the industry. The greater availability of vehicles has provided consumers with more purchasing options, shifting leverage and bargaining power in favor of the consumer and creating downward pressure on prices. This has led to the resurrection of leasing, which now accounts for a quarter of all new vehicle transactions, up more than eight percentage points from 16.6% in September 2022 to 24.9% in August 2024. Particularly in the luxury space, leasing provides customers the opportunity to drive a vehicle they may otherwise be unable to afford.

Rising inventories and higher lease rates are two industry-wide trends that have understandably led to greater brand loyalty. Assuming everything else stays the same, when consumers have more choices within a brand, they are more likely to find what they want - thus enhancing brand loyalty and reducing the likelihood of switching to competitors. Lessees - who have stronger links with the dealer (including having to return the vehicle at lease end) and shorter turn rates - are also consistently more loyal to the brand than owners (again, everything else being equal).

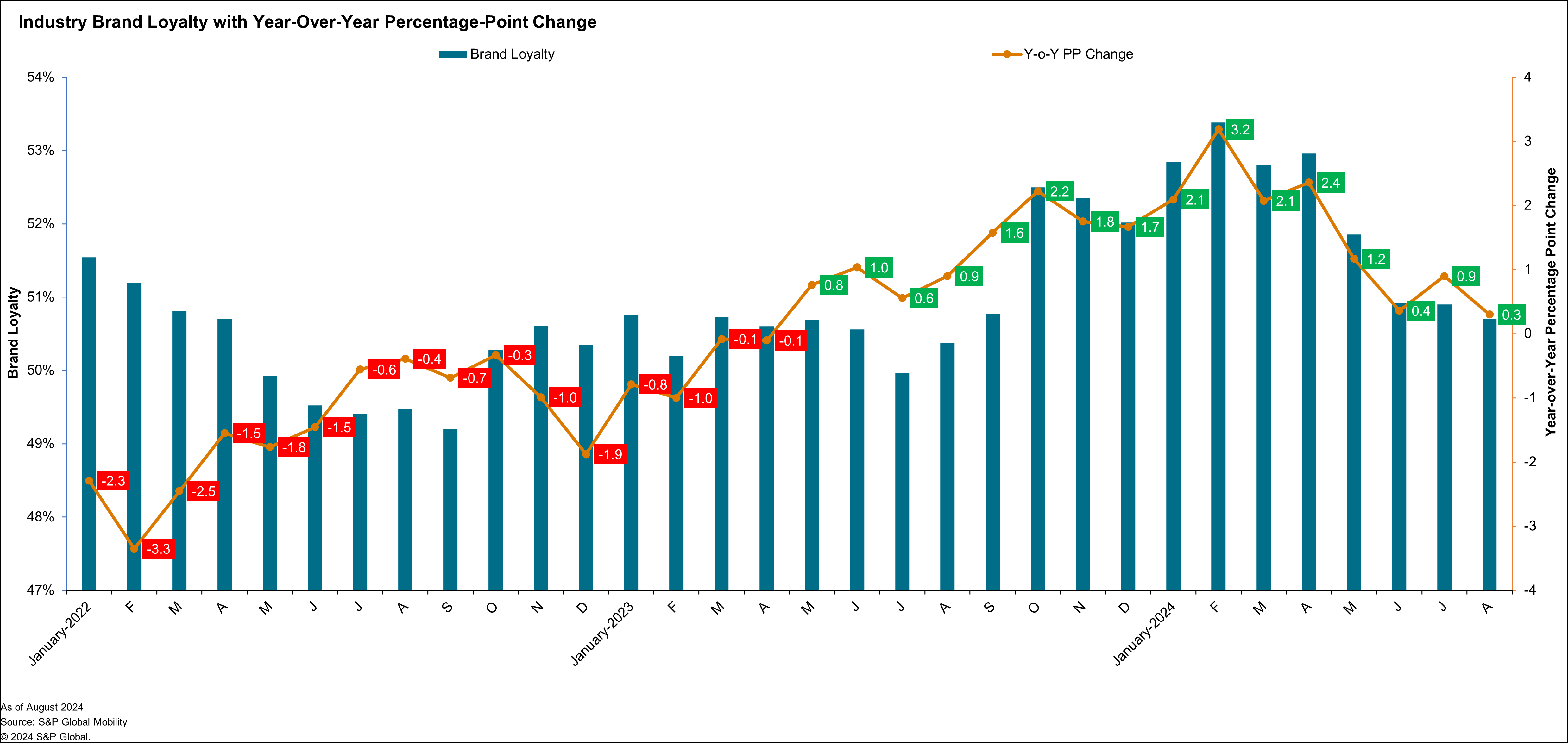

As the following chart illustrates, brand loyalty has climbed in the past sixteen consecutive months year over year after declining in the sixteen prior months. While industry-wide brand loyalty has increased, it is not yet at pre-pandemic levels of 54%-55%.

Historical actual buyer behavior supports these conclusions: The correlation coefficient between dealer inventories and brand loyalty from January 2022 to August 2024 is .60, according to S&P Global Mobility dealer inventory data (see the following chart).

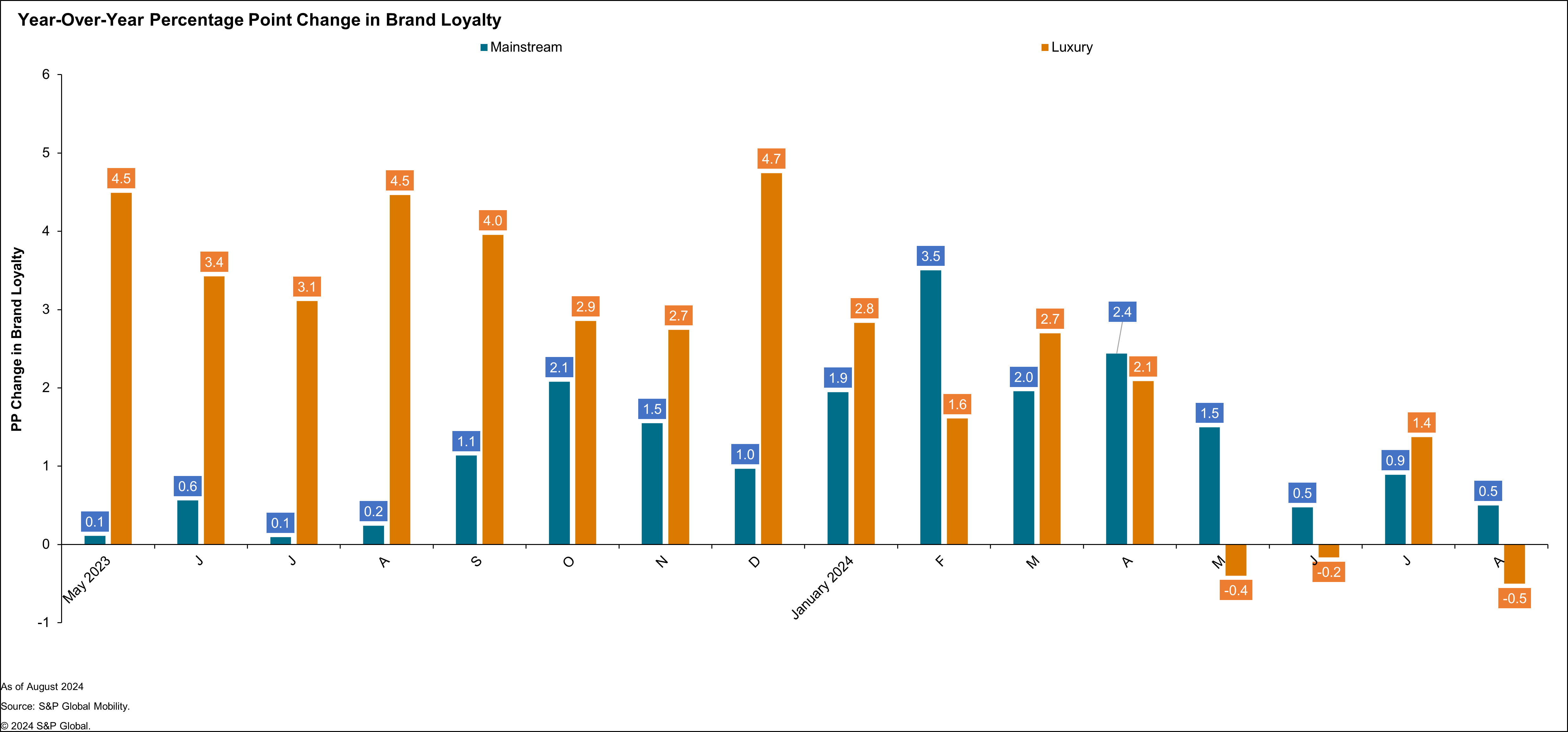

The mainstream and luxury sectors in the market have both

experienced rising brand loyalty over the past sixteen months, with

the mainstream brands increasing every month and the luxury brands

up in twelve months but down in three of the four most recent

months.

Also, as shown in the following chart, during the early part of

this fifteen-month time span, the luxury brands exhibited greater

year-over-year changes than the mainstream brands. This is likely

in part because the luxury brands had dropped further than the

mainstream brands during the inventory-shortage months and

therefore had more ground to make up.

Several brands have had exceptional brand loyalty performances, including Honda (with six models enjoying ten or more consecutive months of loyalty improvement), Volkswagen (also with six models increasing for ten or more months) and Lincoln (with one model claiming brand loyalty improvement for ten consecutive months). Other brands listed below have also excelled, although they have not had the unbroken sequences of improvements.

In conclusion, several S&P Global Mobility metrics, including dealer inventories, leasing penetration and brand loyalty indicate that the industry is well on track to return to its pre-pandemic landscape. However, the August 2024 brand loyalty results (50.3%) and leasing rate (24.9%) are still below the 2019 levels (54%, and 29.5%, respectively), suggesting the industry has not yet fully recovered.

Demo our loyalty analytics tool

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.