As environmental, social and governance (ESG) issues take center stage, stakeholder interest in the green strategies of companies around the world is on the rise. Even if a company appears to be addressing important ESG issues, however, are its subsidiaries on the same course? If not, how could that ultimately affect the parent company and possibly disrupt supply chains and the investing and lending strategies of its banking partners?

To better manage ESG issues, corporations, banks, asset managers and others are looking for solutions that provide a broader view of all the relationships that exist between companies — such as parent-subsidiary, acquisitions and investment arms. In addition, they are looking for insights into debt exposures and credit ratings for this extended group to better understand possible negative impacts on a parent company should a financial obligation not be met by an affiliated firm.

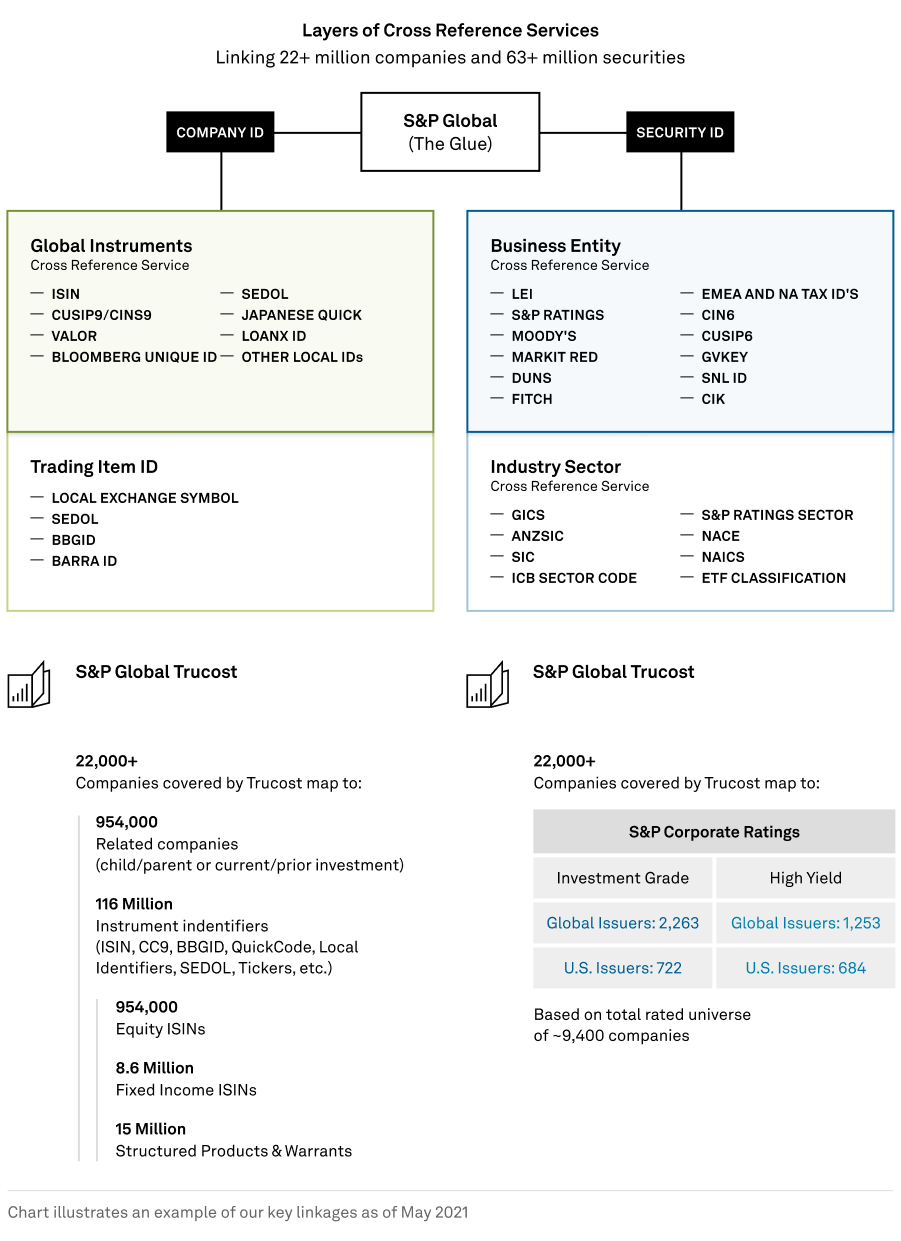

S&P Global brings several proprietary data sets to bear on the issue. As shown in Figure 1 below, there are 22,000+ companies covered in the S&P Global Trucost environmental data set.1 By applying an array of cross reference and company relationship data, users are able to identify 954,000 related companies, along with 116 million associated financial instruments and a total of 4,922 credit ratings.

Figure 1: Expand ESG Data with Cross Reference Services

Source: S&P Global as of July 2021. For illustrative purposes only.

How does this work? S&P Global’s Business Entity Cross Reference Service (BECRS), Global Instrument Cross Reference Service (GICRS), Industry Sector Cross Reference Service (ISCRS) and Company Relationship data come together to provide the solution.

-

BECRS provides immediate cross reference capabilities to millions of public and private entities, companies and issuers using both standardized and proprietary identifiers. This includes: LEIs,2 CUSIPs, D&B Duns IDs, Tax IDs, credit ratings (S&P, Fitch and Moody's) and more.

-

GICRS provides access to a comprehensive database of security identifiers, cross referencing 65+ million instruments globally. This links a security to its ISIN, CUSIP/CINS, SEDOL, Bloomberg FIGI, Barra, Markit LoanX and more.3 Coverage includes equities, fixed income instruments, mutual funds, indexes and more.

-

ISCRS links industry sector classifications at the company level using the S&P Company ID. Industry classifications include: GICS®, SICs, S&P Global Ratings Sectors, NACE and more.4

-

The Company Relationship database provides a view of all links between companies in the S&P universe, including: acquisitions, investments, investment arms, lenders, affiliates, index providers and more. This extensive “family hierarchy” capability seamlessly maps back to BECRS, GICRS and ICRS by using S&P proprietary identifier(s).

In addition to understanding the complex relationships that exist in the marketplace, S&P Global’s unique linking capabilities are used by internal data management groups to create an organization-wide database. This helps efficiently link internal data with external data from multiple third-party providers to give all users access to one comprehensive and consistent source of information. As data needs grow exponentially, having a solid foundation to support decision-making is more important than ever before.

Going Further with Kensho Link

Records of company information are often messy, perhaps containing spelling errors or partial addresses. Kensho Link uses machine-learning technology to suggest links across databases for each entity, along with the model's confidence in the match. Users simply input data, including a series of fields for each entity, such as company name, aliases, address, phone number, URL and year founded to integrate data with S&P Global's Market Intelligence Key Institution IDs. Users can get quick, successful matches with as little as a name, although more information will provide better results.

1 All data as of July 2021.

2 Legal Entity Identifier.

3 ISIN=International Securities Identification Number; CINS=CUSIP International Numbering System; SEDOL=Stock Exchange Daily Official List; FIGI=Financial Instrument Global Identifier.

4 GICS=Global Industry Classification Standard; SICs=Standard Industry Classifications; NACE=European Union standard.

Learn more about how "The Quality Imperative" differentiates our essential sustainability intelligence.

READ MORE >-

Discover multiple layers of ESG insight.

Learn more -

Get comprehensive company analytics and best practice reporting solutions.

Learn more -

Optimize the climate, ESG and impact performance of your investment portfolio.

Learn more

We’re here to help you accelerate your sustainability journey. Get connected with an ESG specialist who can advise you on your next steps.

Talk To An Expert