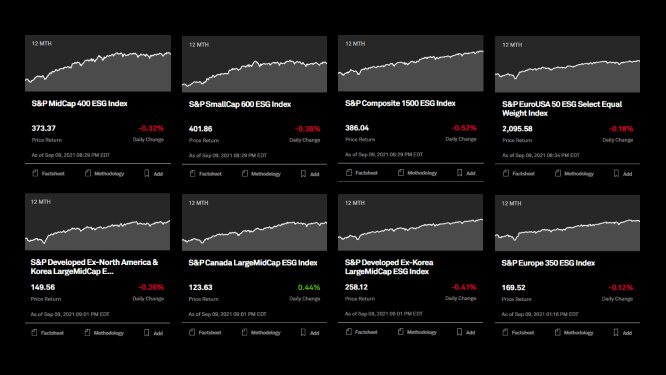

ESG SCORES

Discover a well-rounded picture of ESG performance

ESG Scores

Unlike any other ESG dataset available in the market today, S&P Global ESG Scores – and the CSA research process that underpins them – form the basis of a unique ecosystem that actively drives corporate disclosures and raises the bar on sustainability standards over time.