Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsTrucking in transition: Potential impacts of the 2024 election

By Greg Genette, Analyst, Technical Research and Andrej Divis, Research and Analysis Executive Director

On Tuesday, November 5, 2024, the United States will hold its general election to decide a new president and the new composition of the legislature. All 435 House seats and 34 of the 100 Senate seats in Congress are up for election.

This event will likely shape the future of US climate policies, as the major party presidential nominees hold differing views on climate action as major policy milestones approach. The congressional makeup will also be crucial, with Republicans likely pushing for significant changes in the policy environment and Democrats favoring continuity.

This analysis will explore potential impacts on the medium and heavy commercial vehicle (MHCV) market, notably vehicles above 6.0 metric tons and roughly equivalent to US Classes 4-8.

Where we stand today: Assessing the current environment

The current US trucking market can be categorized into two key areas: First, the economy and truck demand, and second, policy and electrification. Our baseline forecast anticipates a modest increase in the market overall and in the zero-emission segment. With labor conditions loosening and inflation moderating, the US Federal Reserve is expected to continue cutting interest rates in 2024, boosting truck demand after a period of over-capacity and weak carrier profitability.

Truck sales are predicted to remain flat in 2024, but momentum is expected to build toward a record-setting 2026 thanks to improved economic conditions and the temptation to buy ahead of 2027 diesel-truck emissions changes. On the regulatory and policy front, California's Advanced Clean Trucks rule and the federal Greenhouse Gas Phase 3 emission regulations will shape the industry's adoption of electrified vehicles through the midterm. We believe the next 36 months are a critical make-or-break period for industry zero-emission vehicle (ZEV) goals and aspirations. The incoming presidential administration will have the opportunity to shape the energy transition and the trajectory of overall new truck demand.

Trucking through the election: Evaluating potential impacts

The potential impacts of the November election can be categorized and evaluated under the same two areas described previously: the economy and truck demand, and policy and electrification.

Economic growth and demand for new trucks could face two new realities with a new administration taking office next year. Neither presidential candidate is an incumbent, and the election will bring a new administration with two primary pathways that could shift the existing market demand forecast, primarily through new tariffs. The first scenario predicts higher truck sales if the economy exceeds expectations, with lower inflation, interest rate cuts and robust consumer spending boosting demand beyond levels anticipated in our baseline for 2025 and 2026.

Conversely, a second scenario anticipates lower truck sales due to negative economic factors, including a potential trade war, rising tariffs and decreased consumer confidence, impacting overall economic performance and road freight trends. Beneath the surface, it is also important to note that new tariffs could directly hinder the adoption of electrified commercial vehicles, depending on the details. Much of the battery supply chain is based in mainland China, providing a cost advantage. Although efforts to localize battery manufacturing and other critical components are ongoing, the US is still years away from completing this transition. Higher tariffs could discourage buyers by raising prices, further slowing the energy transition in trucking, and it is not clear that such policies would be associated with just one of the presidential candidates.

In summary, from an economic and new truck demand perspective, the key factor to watch regarding the influence of the new administration on the broad truck market is the extent to which new tariffs may be imposed, affecting macroeconomic indicators, new truck demand and the costs of electric vehicle components and batteries.

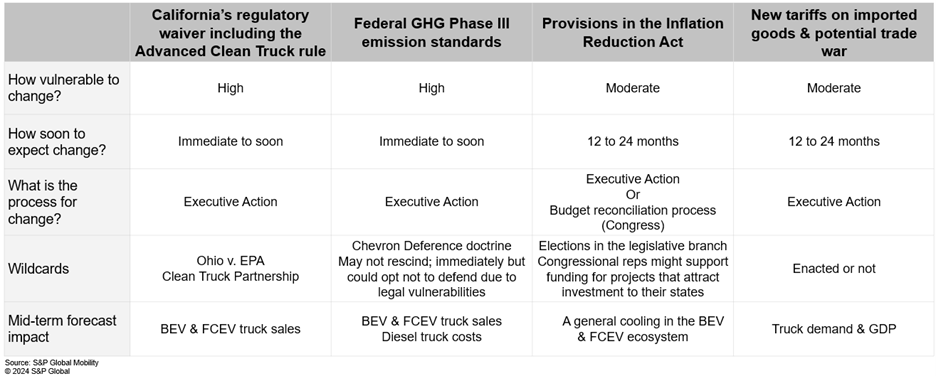

Under a new administration, regulations and the prospects for electrification could face a complex new future. Under current market conditions, zero-emission trucks remain relatively expensive for many truck vocations (applications) relative to a diesel truck, especially without incentives. Therefore, our forecast assumes that stringent regulations will be the primary demand driver for zero-emission trucks through the late 2020s and into the 2030s. A shift to Republican leadership is more likely to significantly change the regulatory landscape for trucking in the US, introducing uncertainty and risk to our zero-emission vehicle forecast. The following paragraphs will explore potential scenarios and their impact on our powertrain forecast. We will focus on three key topics: California's regulatory waiver, the federal Greenhouse Gas Phase 3 standards and the Inflation Reduction Act.

California's regulation waiver:

California's authority to set its own vehicle emissions standards, granted under the Clean Air Act, was revoked by the Trump administration in 2019 but reinstated by President Biden, which enabled California's recent Advanced Clean Truck (ACT) regulation.

Another revocation is one risk under a new administration, but not the only risk in this time period. A pending Supreme Court case, Ohio v. EPA, could challenge California's waiver, potentially disrupting these rules and adding an element of uncertainty to the future of this regulation, regardless of administration. However, many truck manufacturers have committed to following the Advanced Clean Truck rule regardless of legal outcomes, in what they are calling the Clean Truck Partnership, reducing the risk of major changes to market conditions.

In summary, completely eliminating this rule would substantially lower our zero-emission vehicle forecast. However, for this to become reality, several uncertainties would need to be resolved.

Greenhouse Gas Phase 3:

The Greenhouse Gas (GHG) Phase 3 regulation, set to begin in 2027, mandates progressively stricter CO2 standards for medium and heavy commercial vehicles through 2032. Although it does not require the sale of ZEVs, it does encourage indirectly them through the tightness of the standards.

We expect a Democratic administration to keep this regulation in place and perhaps extend and tighten these emissions rules beyond 2032. A Republican administration may be more open to listening to critics of the measure and perhaps rescind and weaken these standards, potentially delaying their enforcement.

Meanwhile, the Supreme Court's ruling against Chevron Deference could lead to increased legal challenges against EPA regulations, adding further uncertainty to the trucking industry and the future pathway for GHG regulations. Changes to delay or lessen GHG standards are likely to diminish our outlook for zero-emission truck adoption, particularly in the late 2020s and early 2030s.

The Inflation Reduction Act:

The Inflation Reduction Act (IRA), passed in 2022, allocated $369 billion for climate and clean energy, including several key investments for decarbonizing trucking. The IRA notably offered up to $40,000 in tax credits for clean commercial vehicle purchases, as well as incentives for infrastructure and clean hydrogen.

While a new administration may modify parts of the IRA, a full repeal is unlikely, due to the legislative process required to do so and due to the support for diverse parts of the legislation from across the political landscape. Even so, the $40,000 tax credit is not expected to significantly accelerate zero-emission truck adoption in the near term owing to high costs and operational challenges.

Conclusion

Under a Republican administration the following have the potential to change:

This election could significantly impact the US trucking industry by reshaping tariffs, regulations and climate policies. Potential changes like revising California's emissions waiver, rescinding and redrafting federal GHG Phase 3 standards, and modifying provisions of the Inflation Reduction Act could potentially slow electric truck and bus adoption. The timeline for these changes, especially within the first 100 days, remains uncertain. Key wildcards like the Ohio v. EPA case, the overturning of Chevron Deference, and election outcomes in Congress could further influence regulatory adjustments in this highly regulated and economically sensitive industry.

Download our free MHCV forecast by region.

Learn more about our commercial vehicle solutions.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.